A Skeptic’s Thesis on Open Forest Protocol

July 29, 2024

Michael Kelly, Open Forest Protocol Co-Founder

It’s fashionable today to pitch your project in the ‘best light possible’. This can lead to the ‘fog of the bull market’ and unrealistic foresight into which products actually hold market fit, for the world that is emerging before us.

The first qualification that we should clarify before delving into the skeptics thesis on Open Forest Protocol, is on the nature of investing. Investing, by its own definition, is about gaining exposure to something before that something appreciates in value or visibility or both. No one in their right mind expects to be able to invest one day, and immediately withdraw appreciated value the next. In fact, the best investors of past generations, invest in macro trends - the digitization of information, software as a service, war, real estate, and so forth - on a multi-decade timeframe. In crypto especially, which is largely an industry of amateurs finding their way in this new world of value, it is easy to forget that.

In a similar vein, it is easy to forget that some of the most lucrative investments, early enough in time, are entirely unintuitive to many people - because the possibilities that such investments unlock - have been hitherto unimaginable. This was very much the case for Bitcoin and Ethereum.

Okay, enough qualifications. My job going forward is to explain to everyone why Open Forest Protocol is a fundamental investment in the future - from a skeptical perspective. That means that I am not going to be pitching you on the morality of climate change, nor on the future of expectations surrounding the voluntary carbon market.

We are instead going to imagine, that I am a cynical realist who believes that greed and envy drive the world, and that macro-trends are largely shaped by these motives as opposed to moral imperatives or potentially impactful investments. And the result of this pitch is a skeptical thesis on why you cannot ignore Open Forest Protocol.

Part 1: Climate Expectations and Climate Pressure

To start, we are going to assume that we are climate skeptics. We don’t believe in climate change, that carbon dioxide heats the atmosphere, nor that there is any real urgency in addressing the destruction of our world.

The world however, may think differently. So we’ll start by asking ourselves:

What does the macro-environment suggest, is a realistic future for how governments, investors, and individuals view their relationship with the environment?

Removing all judgment as to whether their motivations are grounded in reality, we are actually trying to understand how the world is thinking about the future of humans and the environment.

This is what we see:

- Virtually all Western Countries are pressuring their populations, their private corporations, and different government agencies, to prepare for a future of radical climate change. This goes from the United States Military, to the United Nations, to massive agricultural giants like Cargill.

- Many countries in the global south are capitalizing on this top-down pressure, to fund eco-tourism, agroforestry, conservation financing, and natural asset generation. This ranges from commitments to reforestation at COP-27, to self-set biodiversity goals committed for 2030.

- There is a radical sense of urgency amongst the younger generations, specifically beginning from Gen-Z. This urgency trickles into consumer behavior, academic interests, and entrepreneurial endeavors. The younger generations are ‘drinking the kool-aid’ on climate change, and are urgently pressuring governments and private industry to divest, actively looking for energy breakthroughs, and avoiding carbon intensive products (like Meat) as best as they can understand.

- Private corporations are imposing self-set drawdown goals, to limit their carbon emissions by specific dates. Cities have also set net-zero sustainability targets, while some local jurisdictions have mandated compliance with certain emission targets for different types of businesses.

- Activists - from Greta Thunberg - to Amazon rainforest protectors - are becoming increasingly aggravated at the lack of progress in protecting basic biodiversity and natural assets year over year.

What do these trends tell us?

As a cynical skeptic, we might first conclude that the world has gone mad, is seriously disturbed, or being manipulated in some way. But as investors, we would realize that the rate and momentum of the ‘climate trend’ is not something that is going to disappear anytime soon. We might realistically view the climate pressure as largely ‘smoke and mirrors’ but where there is a global sense of urgency and a belief in a specific outcome (dropping CO2), there is also financial opportunity. And other investors, financial markets, and individuals are aware of that as well. So we would start by taking the climate macro seriously. Our conclusion would look something like this:

- There are going to be incentives and demands for radically altering our relationship with the environment. This will most likely be reflected across how private industry uses energy, how they compensate for the energy that they use, and how governments, and individuals interact with their environment.

- The urgency and interest from the younger generation, would suggest these incentives and demands will accelerate into the medium to long term future - barring an ‘ahead of schedule’ success in achieving the goals set from the top.

- There is a financial and political greed (being the cynical investors we are), in either financially benefiting from this macro trend, or politically benefiting from it (some form of carbon credit allowance imposed from the top-down as a control mechanism). This suggests, all things being equal, there would be no pressure to stop this trend, out of self-interest from either the financial or political sector.

Check. Climate change is money and power, and will be increasingly relevant for the long-term future.

Part 2: Saturation and Opportunity Within The Climate Industry

We realize now that we cannot ignore climate change in the future - at least for much of the world. And we also realize that this macro trend will inevitably impact everyone because governments and public markets have an interest. These presuppositions are required for the next part of our thesis.

We start this part, by asking the following questions:

- Where is value accruing from this macro trend?

- What facets of this trend are already saturated?

- What facets of this trend have been overlooked?

The first question is quite straightforward:

From a commercial perspective, value is accruing through the invention of new types of financial instruments designed to capture this ‘green value’. We are referring primarily to carbon credits, green bonds, biodiversity credits, and even tax-deductible equity in businesses that are working on the problem. We realize in our digging, that governments have left a wide lane for consumer pressure, and private pledges, to play a role in financializing a solution to the climate crisis. And that the primary instruments of these solutions are rooted in new types of value being created to reflect these commitments.

Second, value is accruing through certain private companies with ‘narrative’ power over their ability to solve the climate problem in some radical way. Tesla is perhaps the clearest example (even though Electric Cars may not solve our climate woes). Others would be breakthrough energy laboratories, sustainable recycling companies, fashion brands with new sustainable designs, and so forth. But on looking deeper, we realize that a lot of these companies have simply leveraged a narrative around the idea of being sustainable - without an adequate system in place - to truly become sustainable or scalable. This is the power of narrative.

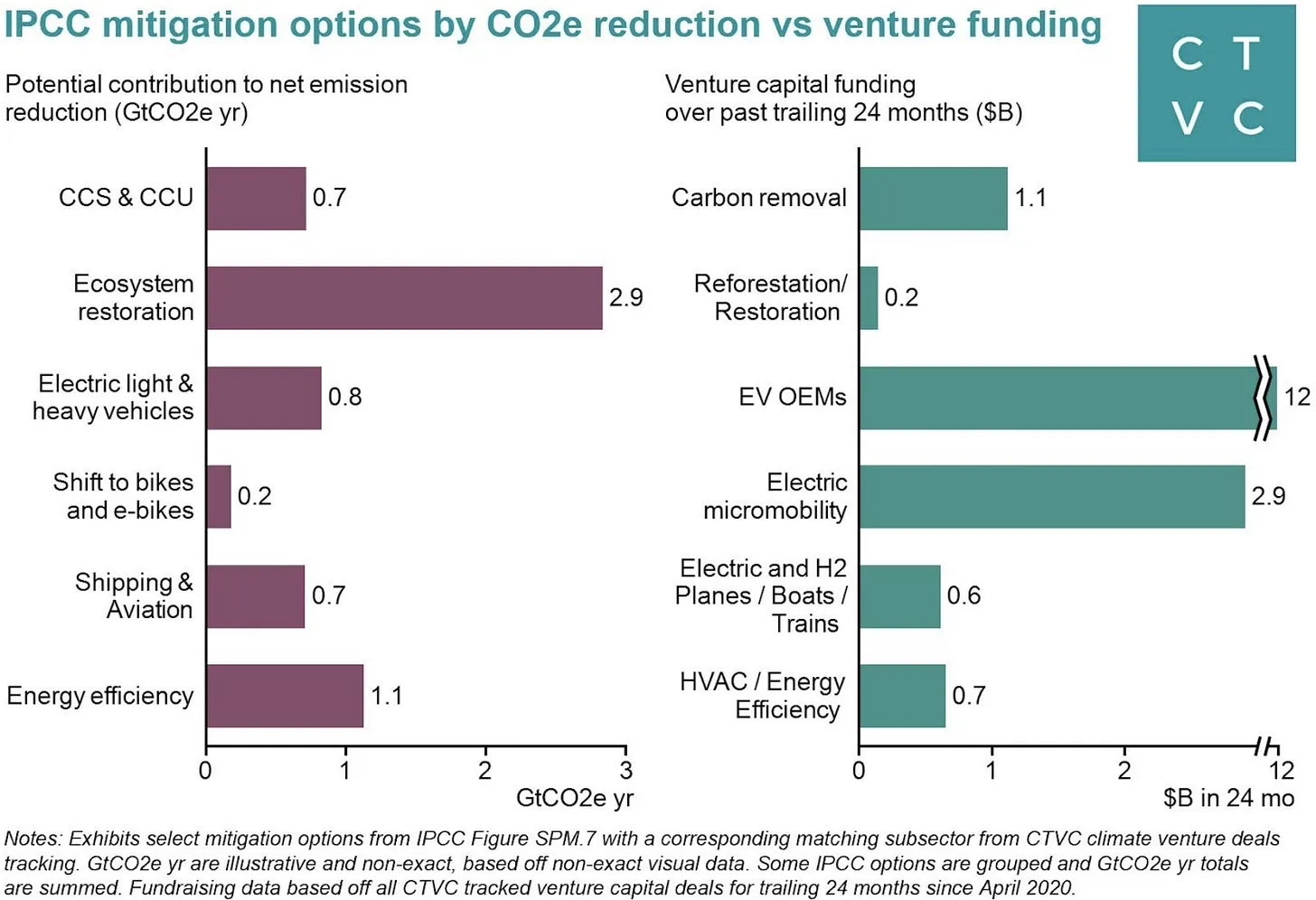

The next two questions can be nicely summarized in the following graphic, courtesy of Climate Tech VC:

What this graphic screams out to us, is a very clear asymmetry, that should catch any greedy investors eye. Bang for buck, in line with the macro-trend that much of the world is preoccupied with, there is a massive hole in investment, in one of the most - if not the most - high potential areas to address the environmental crisis that the world has decided to believe in, and that young generations are preoccupying themselves with: Ecosystem Restoration. Which refers to the regeneration, protection, and sustainable management of natural ecosystems.

What’s more, the scope of Ecosystem Restoration is massive in its implications on global markets: How many people, cities, companies, and governments, are impacted by ecosystem restoration? Think, water supplies to cities, species diversity, and forest cover from desertification. How much potential value lies in this investment asymmetry? Or put from another direction, why is there such an asymmetry in the first place?

What we realize from part two is the following:

- The emergent value from this macro trend is in the form of publicly traded financial instruments, or private companies with massive narrative potential.

- The asymmetry in this trend is centered strongly on ecosystem restoration, which for some reason, has been horribly under-invested in, relative to other carbon mitigating verticals. Nevertheless, this vertical remains extremely applicable in its broad scope, and narrative appeal.

Part 3: Investing in Scalable and Disruptive Innovation

The third and final part of the skeptics thesis, is a direct take on Open Forest Protocol. In this part, we will wade through the weeds of crypto (which we have not mentioned much yet), and contextualize the solution in its context, as the greedy cynical investors that we are. To guide this part, we start by asking the following questions:

- Why is Open Forest Protocol Innovative?

- How Does It ‘Fit’ With The Rest of the Carbon Market?

- Is there narrative appeal behind it?

Before delving into these questions, a small note on crypto and the nature of protocols as a whole. Oftentimes during periods of wealth mania or exponential innovation, it is common for investors to refer to the idea of investing in ‘picks and shovels’ as a reference to being at the foundation of the new value created. So for example, when gold mining was in its mania phase in the 1800s, the money was made not in gold mining itself, but in investing in those selling picks and shovels to those gold mining - or so the common example goes.

Crypto-denominated protocols - with proper crypto-economic designs - operate in a similar manner. A network like Ethereum, harvests billions of dollars per year in transaction costs, simply because other applications and creators have built profitable services on top of Ethereum. As an investor if you had purchased Ethereum prior to this value emerging, you could stake all of that ETH today on the network, and enjoy passive revenue from the network effect of the Ethereum blockchain, and the price appreciation from burned transaction costs (thanks merge!).

This is especially relevant for understanding Open Forest Protocol. Because what Open Forest aspires to do, is operate in a similar manner, for the financialization of natural assets. In other words, OFP is a ‘picks and shovels’ play, attempting to ground a future for ecosystem restoration, in such a manner whereby early investors into OFP - via the $OPN token - are positioned to harvest the value accrual to the protocol in the coming decades.

This leads us into our first question as to why OFP is innovative in the first place. Here are some facts to keep in mind:

- The first, on-chain native, natural asset supplier. This means for any conversation in the future surrounding the financialization of nature, or CO2 related assets, OFP is an infrastructure such that the assets can be created on a distributed ledger, independently, scalably (see more below) and globally liquid (directly accessible through a composable digital market).

- The first, natural value-yielding financial asset. Once more keeping our understanding broad, ‘value-yielding’ could refer to anything from Carbon Credits, to Biodiversity Credits, to Green Bonds, to other forms of value. The design of OFP is such that a protocol fee takes a certain percentage of created value from the protocol, and pushes that value out to token holders ‘planted’ on the protocol.

- A scalable solution for a hitherto unscalable industry. OFP is uniquely designed to outsource verification of nature-based projects to a network of digital validators. These validators are in charge of cross-referencing uploaded data with previously hashed on-chain data supplied by the project. While legacy incumbents in ecosystem restoration have struggled to manage projects at scale (just over 400 in about 20 years), the addressable market, and rapid loss of ecosystems, has already forced many to look for alternatives.

- A Network Effect-based system that is globally accessible, and relevant for the largest untapped climate market in the world. Nature remains the largest untapped climate market. We estimate over 2.4 billion hectares of potentially applicable assets that could be applied to Open Forest. This refers to reforestation land, conservation and biodiversity hotspots, as well as mangrove forests, improved forest management sites, and agroforestry.

- A narrative play that everyone can get behind. Because the scope of ecosystem restoration is so large, it is easy (and of self-interest to everyone) to support such a narrative, once that nature can be monetized. In other words, this suggests that OFP is one of the only products in existence whereby Gen-Z, Oil Companies, Commercial Banks, and Amazonian activists, would all be interested in aligning support behind the protocol as a whole.

- A decentralized and independently accessible system for nature-based value exposure. Unlike a private company, OFP is a protocol. This means that anyone can leverage it, in line with the mechanism design of the system - and as such no one can deter or limit access to the services offered by OFP. This makes OFP extrajudicial, and relevant for any government, company, or business in the world. It also means, in dystopian scenarios, that OFP will be one of the only incorruptible carbon / natural asset suppliers to a market that could easily become politically influenced or manipulated (i.e. individual carbon allowances).

- A constant liquidity event to all investors and protocol participants. Tokens mean immediate / constant liquidity events. It is the safest possible long-term investment a fund can make, because instead of waiting for an IPO or a merger or acquisition, the protocol obtained value can be exited at any time on a public market (assuming the assets are unlocked). Usually in crypto, the race is to dump prior to the rest of the market. For OFP, investors are uniquely positioned insofar as the narrative surrounding nature-based value generation is positioned to supersede short term market dynamics (i.e. there will be more interest in OFP over time, than short term ‘dumping’ and financial speculation).

The second question about OFP, referred to how it ‘fits’ with the rest of the market. We can answer this question in the following manner:

- OFP is a supplier of nature-based financial assets.

- Much of the existing market is focused on market making, pre-financing, or technology development.

- OFP is uniquely positioned to supply any other partner marketplace or stakeholder, interested in the global financial interest in the OFP-generated assets.

- There are few other ‘natural-asset’ generators in existence, largely because of the demand for a stringent, respected, and durable system capable of inspiring confidence in the creation of ‘nature-based’ assets (whether OFP offers such a system can be contested, and is a separate conversation in itself).

In a way, OFP as an investment, is like investing in the company that makes picks and shovels, to sell to the people, looking to sell picks and shovels. It is the ‘bottom’ of the supply chain in natural asset generation. But it is systematically and digitally designed, to operate as a protocol which harvests value and pushes that value into the utility token of the protocol - $OPN.

Our final question has to do with narrative potential. And for the cynical investor, this may be most enlightening. Take a step back and consider parts 1 and 2 of this thesis. Think about - realistically - what fear, self-interest, and greed alone will do in reference to the ‘climate’ trend in the coming 20 years. Think about the asymmetry surrounding natural assets, yet the public market appeal of ‘green’ backed financial instruments. Think about the future of value moving onto blockchains, and the narrative surrounding Carbon Credits, Biodiversity Credits, and corporate pledges to address the climate issue. And then finally think about the energy and passion of the youth from around the world - and the reality many cities and people face, at loss of water, desertification of land, extreme flooding, and so forth.

Keeping all of that in mind - you realize this about the promise of Open Forest Protocol:

It’s not even a question of if you think OFP as a solution will work. It is actually a question of whether the solution has sufficient narrative power, to stay in the global conversation, and to accrue value on the promise of working over time? This is cynical realism at its finest. And the asymmetry in ecosystem restoration, coupled with the macro trend, and the innovative promise of OFP itself, suggests very clearly that there is unquestionable narrative power in the protocol itself. The conservative starting point assumes OFP won’t actually deliver on its promise anytime soon - but rather - that the promise of OFP itself has sufficient narrative potential to garner value and support.

Conclusion

To conclude, we assume the reader is sufficiently versed in the following areas:

- The state of climate commitments, urgency, actions, and planning from the likes of most governments around the world, many private corporations, and the demographics on youth concern over the climate crisis.

- The mechanical design of Open Forest Protocol from both a technical and economic perspective (not an easy thing to ‘get’ if you are not well versed in crypto).

- The state of the ‘ecosystem-restoration’ industry, and its problems and needs.

- The future promise of ‘nature-based’ assets as an emerging financial asset class, as a basis for creating a market mechanism for solving drawdown / climate mitigation pledges or requirements.

The aforementioned areas are not largely contestable. Meaning, these areas are ‘descriptive’ by nature, and are not controversial per se. It is rather about making judgements on the rate, evolution, and adoption of these different areas, where one may make an argument for or against a specific case.

The most important conclusion we hope a cynical and self-interested investor takes away from all of this, is that climate as a problem is not going away in the future. And, in fact, it is only going to get larger. With that in mind, the central thesis on the monetization of nature, the supply of natural-assets, and the financial future of ‘addressing climate change' largely centers on ecosystem restoration - and as an inference - Open Forest Protocol. You do not need to care one bit about the climate, to realize, OFP is a forward looking investment, with strong narrative potential, massive network-effect implications, and gigantic addressable markets.